How Robotic Process Automation is Transforming the Banking and Finance Industry

The banking and finance industry has always been ahead in the adoption of new technologies. From the introduction of Automated Teller Machines (ATMs) to online banking systems, institutions have always strived to reduce costs, offer the best services and outcompete their competitors. Currently, the field of operation that is fastly evolving and gaining populaxrity in the banking and financial sector is Robotic Process Automation (RPA).

What is Robotic Process Automation (RPA)?

RPA refers to the use of software robots to automate repetitive, rule-based tasks. These software bots mimic human actions by interacting with various applications and systems, following predefined workflows. Unlike traditional automation solutions that require complex programming, RPA tools are user-friendly and can be easily deployed to automate a wide range of tasks and ultimately help increase employee productivity.

How is RPA Used in Finance? Top Use Cases

Financial institutions handle massive volumes of data and perform countless repetitive tasks daily. A prime example is where Gartner predicted a significant increase in RPA implementation among corporate controllers in the finance sector, from 19% in 2018 to a projected 73% by 2020.

The top use cases are:

- Account Opening: RPA can streamline the account opening process by collecting customer data, verifying information, and generating account documents.

- Know Your Customer (KYC): RPA bots can automate the collection and verification of KYC documents, simplifying the onboarding process and reducing human error.

- Loan Processing: RPA can automate data entry, verification, and document management during loan applications, leading to faster processing times and improved customer satisfaction.

- Customer Service: RPA can handle routine customer inquiries, such as account balance inquiries, password resets, and address changes, freeing human agents for more complex issues.

- Fraud Detection and Compliance: RPA can monitor for suspicious activity, analyze transaction patterns, and trigger alerts for potential fraud attempts. Additionally, RPA can automate compliance reporting and data aggregation, ensuring adherence to regulations.

- Back-End Operations: Repetitive tasks like data reconciliations, report generation, and data migration can be automated with RPA, freeing up back-office staff to focus on more productive activities.

Benefits of RPA in Banking and Finance

RPA offers multiple benefits for banks and financial institutions. These are:

- Digitise and automate tasks: Smart bots can also be used in entering and re-entering financial data accurately hence eliminating repetitive tasks.

- Avoid errors in processes: It is suitable for rule-based processes that constitute insurance and mortgage enterprises. RPA bots are capable of performing comprehensive searches and comparisons flawlessly, eliminating costly errors and ensuring a 0% failure rate.

- Automate documentation and standardisation: RPA simplifies the finance and accounting industry by easily standardising official documentation and keeping important data and customer records.

- Achieve better efficiency and returns: The automation of processes in the finance sector results in process change. And, efficient processes and business functions translate into gains.

The Future of RPA in Banking and Finance

As RPA technology continues to evolve, we can expect to see even greater integration with artificial intelligence (AI). This combination of RPA and AI, often referred to as Intelligent Automation, allows software bots to learn and adapt to changing circumstances.

Here are some exciting possibilities for the future of RPA in banking and finance:

Integration with IoT

The integration of RPA with IoT devices brings new opportunities for automation. For example, loT-enabled ATMs can be integrated with RPA to help banks control cash levels and performance. This integration can also include other banking equipment and structures to monitor and maintain them in real time.

Enhanced Cognitive Capabilities

This technology is an evolution of RPA but includes elements of Al and ML to address tasks that need decision-making and problem-solving skills. Cognitive RPA can be applied to customer onboarding where it performs document checks, data input, and compliance. This will not only make the onboarding process faster but also more accurate. Ultimately, this will help in improving the overall customer experience.

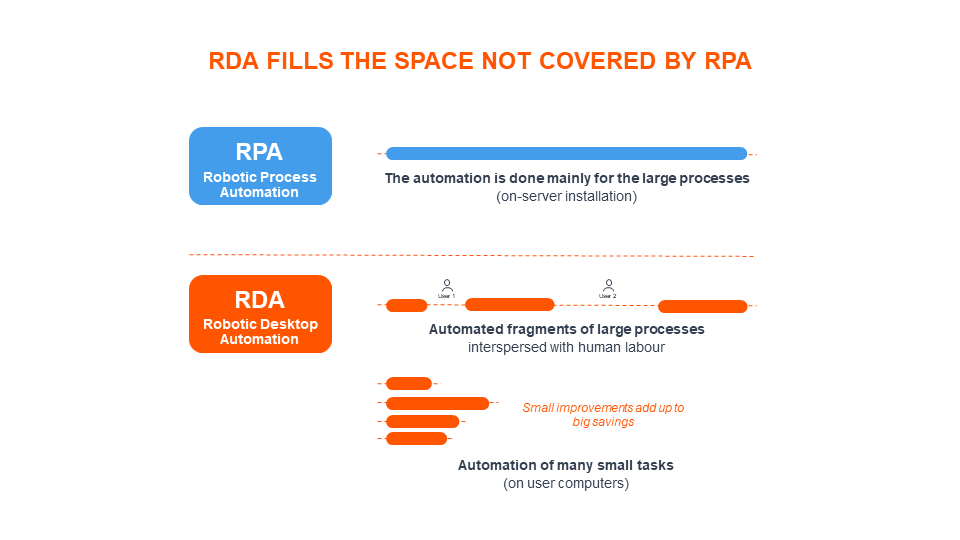

Robotic Desktop Automation (RDA)

Unlike RPA which focuses only on back-end operations, RDA helps employees with their front-end operations. This can involve data input, information search, and customer relations. RDA facilitates automated such tasks so that the employees can be free to engage in more productive work.

Credit – automade.com

Personalised Customer Service

When RPA is integrated with Artificial Intelligence, it can provide customised customer services to satisfy the needs of the customers and their queries.

Conclusion

Robotic Process Automation is undoubtedly revolutionising the banking and finance Industry. Thus, it opens new opportunities for banks and financial institutions to provide better services to their clients and improve the results of their tasks with the help of RPA by increasing speed and accuracy.

Need Professional Help? Our RPA services are flexible to ensure that they address your organisational needs most appropriately. Our Robotic Process Automation services include:

- Assessment and Strategy: We help you identify areas where RPA can be most beneficial and develop a customised automation strategy.

- Implementation: Our experienced team will implement RPA solutions seamlessly into your existing business process.

- Ongoing Support: We offer ongoing support and maintenance to ensure your RPA systems continue to run smoothly and efficiently.

Contact Robotico Digital today and let our team of RPA experts help you enhance your operations, increase customer satisfaction, and stand out from your competitors