Top 9 IT Security Challenges Facing the Finance Industry in 2024

The financial industry has been a primary source of interest among hackers and cybercriminals since it possesses a lot of customer information. In 2024 financial institutions will have to deal with the constantly changing threats of IT security. Thus, as the threat actors progress in their development and as technologies evolve, so does the nature of attacks and attack methods. Therefore, we need to identify the best IT security risks that the finance industry will be facing in 2024 and how the financial institutions can avoid these risks.

1. Phishing and Social Engineering Attacks

Phishing attacks remain one of the most common threats to financial institutions. These attacks attempt to trick employees into revealing sensitive information or clicking on malicious links. Social engineering tactics are often used in phishing attacks to play on human emotions and manipulate victims into taking unwanted actions. IBM’s Cost of a Data Breach Report 2024 found that phishing attacks were the most common cause of data breaches, which has increased 10% over last year.

Here are some ways financial institutions can mitigate phishing and social engineering attacks:

- Employee training: Regularly train employees on how to identify and avoid phishing attacks. This training should cover common phishing tactics, such as spoofed emails and urgent requests.

- Multi-factor authentication (MFA): Implement MFA to add an extra layer of security to logins. MFA requires users to enter a second factor, such as a code from a mobile authenticator app, in addition to their username and password.

- Email filtering: Use email filtering software to block suspicious emails from reaching employees’ inboxes.

2. Ransomware Attacks

Ransomware attacks are a serious threat to financial institutions. Ransomware encrypts an organization’s data, making it inaccessible until a ransom is paid. Ransomware attacks can be devastating for financial institutions, as they can disrupt operations and cause significant financial losses. A study by Cybersecurity Ventures predicted that ransomware damages will exceed $265 billion by 2031.

Here are some ways financial institutions can mitigate ransomware attacks:

- Regular backups: Regularly back up data to a secure offsite location. This will allow you to restore your data in the event of a ransomware attack.

- Patch management: Keep all systems up to date with the latest security patches. This will help to close vulnerabilities that attackers can exploit.

- Endpoint security software: Implement endpoint security software to detect and prevent malware infections.

3. Cloud Security Challenges

The increasing adoption of cloud computing has introduced new security challenges for financial institutions. Cloud environments can be complex and difficult to secure. Additionally, financial institutions must be mindful of the security of their data when it is stored in the cloud.

Here are some ways financial institutions can mitigate cloud security challenges:

- Choose a reputable cloud provider: Choose a cloud provider with a strong security track record.

- Use cloud security tools: Use cloud security tools to monitor and protect your cloud environment.

- Encrypt your data: Encrypt your data at rest and in transit to protect it from unauthorized access.

4. Supply Chain Attacks

Supply chain attacks target third-party vendors and suppliers of financial institutions. Attackers can compromise a vendor’s systems and gain access to the financial institution’s data through the vendor’s network. Gartner predicted that supply chain attacks would increase by 72% worldwide in 2024 due to the growing complexity of supply chains.

Here are some ways financial institutions can mitigate supply chain attacks:

- Third-party risk management: Conduct thorough risk assessments of third-party vendors before doing business with them.

- Contractual obligations: Include security requirements in contracts with third-party vendors.

- Monitor vendor activity: Monitor the activity of third-party vendors for suspicious behavior.

5. Evolving Regulatory Landscape

The regulatory landscape for IT security is constantly evolving. Financial institutions must comply with a variety of regulations to protect customer data.

Here are some ways financial institutions can stay compliant with IT security regulations:

- Stay up to date on regulations: Stay up to date on the latest IT security regulations that apply to your busin

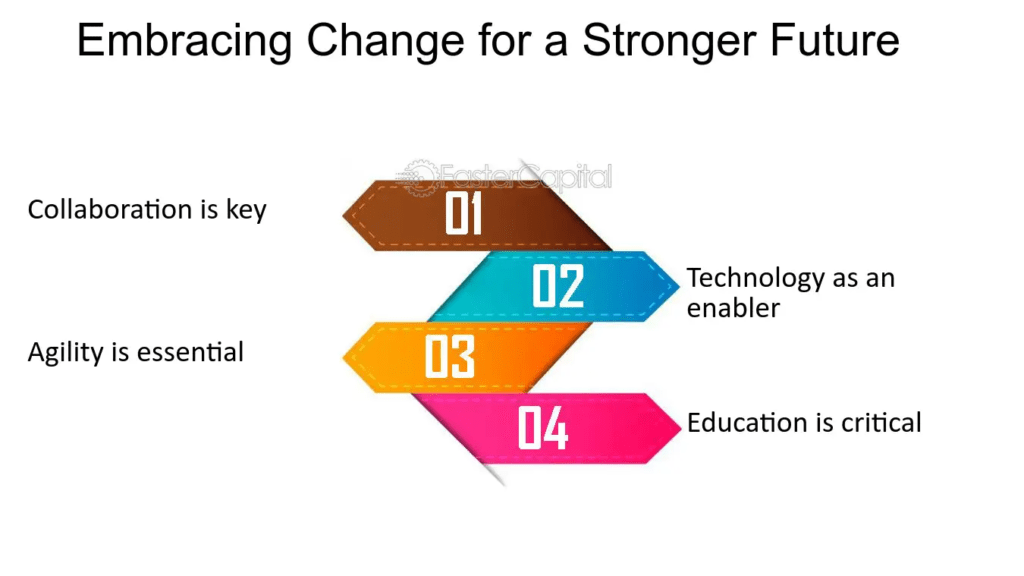

Steps to adapt in Evolving Regulatory Landscape

Source – www.fastercapital.com

- Conduct regular compliance audits: Conduct regular compliance audits to identify and address any gaps in your IT security controls.

- Invest in compliance training: Invest in compliance training for your employees.

6. Internet of Things (IoT) Security Challenges

The Internet of Things (IoT) is a growing trend that is having a major impact on the financial industry. However, IoT devices can also introduce new security challenges. IoT devices are often not well-secured and can be exploited by attackers.A study by Palo Alto Networks found that 75% of IoT devices have vulnerabilities that can be exploited by attackers.

Here are some ways financial institutions can mitigate IoT security challenges:

- Secure IoT devices: Only use IoT devices that have strong security features.

- Segment IoT devices: Segment IoT devices from other parts of your network to limit the damage if an IoT device is compromised.

- Monitor IoT devices: Monitor IoT devices for suspicious activity.

7. Insider Threats

Insider threats are a growing concern for financial institutions. Insider threats can be deliberate or unintentional. Employees may accidentally expose sensitive data or may intentionally steal data for personal gain.

Here are some ways financial institutions can mitigate insider threats:

- Employee background checks: Conduct thorough background checks on all employees.

- Access controls: Implement strong access controls to limit employee access to sensitive data.

- Employee monitoring: Monitor employee activity for suspicious behavior.

8. API Security

APIs are increasingly being used to connect financial institutions with third-party vendors and customers. However, APIs can also introduce new security risks. Attackers can exploit vulnerabilities in APIs to gain unauthorized access to data. OWASP identified API security as one of the top 10 web application security risks.

Here are some ways financial institutions can mitigate API security challenges:

- API security testing: Conduct regular API security testing to identify and fix vulnerabilities.

- API token management: Implement strong API token management practices to protect API access.

- API traffic monitoring: Monitor API traffic for suspicious activity.

9. Cloud Migration Challenges

Many financial institutions are migrating their IT infrastructure to the cloud. However, cloud migration can introduce new security challenges. Financial institutions must be mindful of the security of their data when it is stored in the cloud.

Here are some ways financial institutions can mitigate cloud migration challenges:

- Choose a reputable cloud provider: Choose a cloud provider with a strong security track record.

- Use cloud security tools: Use cloud security tools to monitor and protect your cloud environment.

- Encrypt your data: Encrypt your data at rest and in transit to protect it from unauthorized access.

Conclusion

The IT security landscape is constantly evolving, and financial institutions must be vigilant to protect themselves from emerging threats. Robotico Digital understands these security challenges facing by finance industry and help these industries in implementing effective mitigation strategies, financial institutions to reduce their risk of cyber attacks and protect their customers’ data.

Contact us today to learn more about how we can help you mitigate IT security risks and protect your financial institution.